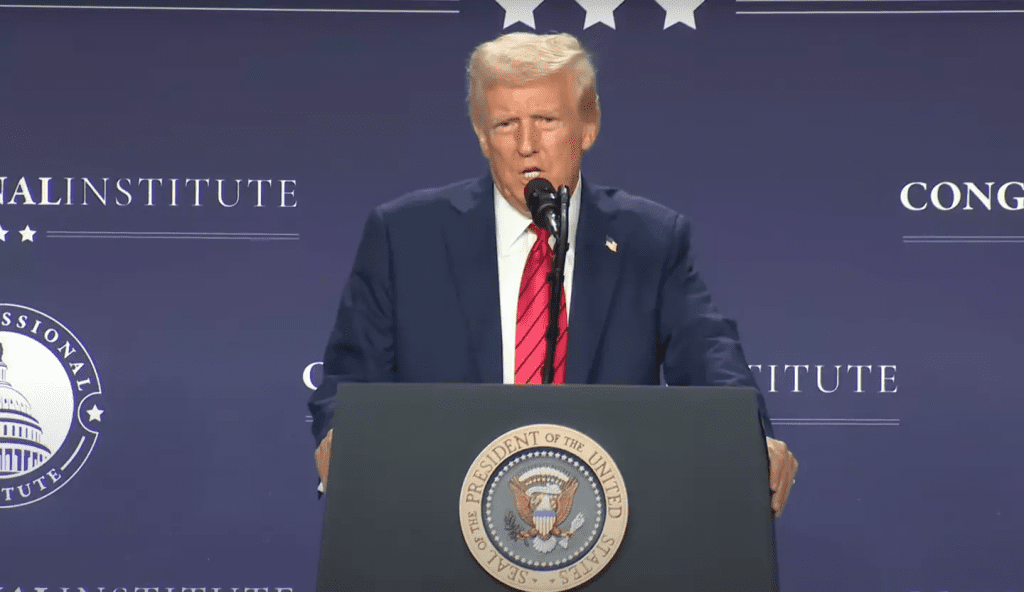

Former President Donald Trump has once again made headlines with a bold economic strategy aimed at reshaping America’s financial landscape. Speaking at the House GOP retreat at his Trump National Doral golf club in Miami, the 78-year-old leader revealed his ambitious vision for the United States—one that involves aggressive tariffs, economic restructuring, and the elimination of federal income taxes.

His plan? Tax foreign goods instead of American citizens—a move that has sparked intense debate among economists, politicians, and the public. Some see it as a bold step toward restoring U.S. economic dominance, while others fear it could trigger a trade war and lead to higher prices for consumers.

Let’s break down Trump’s shocking proposal and what it could mean for the future of the American economy.

Trump’s Vision: Tariffs Over Taxes

During his speech, Trump doubled down on his belief that the U.S. should return to the tariff-driven economic system that once made the country a powerhouse.

“America is going to be very rich again, and it’s going to happen very quickly,” Trump declared. “It’s time for the United States to return to the system that made us richer and more powerful than ever before.”

He referenced the period between 1870 and 1913, when the U.S. economy thrived on tariffs rather than income taxes. According to Trump, this era saw so much government revenue from tariffs that policymakers had to figure out how to spend the surplus.

“They set up the great Tariff Commission of 1887… and this commission had one function—what to do with all the money we took in. It was so enormous that they had no idea,” he explained.

The key takeaway? Trump wants to shift America back to this economic model, replacing federal income taxes with heavy tariffs on imported goods.

How Do Tariffs Work? A Simple Breakdown

Since Trump is pushing tariffs as the solution, it’s important to understand how they work.

A tariff is essentially a tax on imported goods, paid by businesses that bring products into the country. Here’s what happens when a tariff is imposed:

- Foreign-made goods become more expensive because businesses have to pay the tax before selling them.

- American companies become more competitive since their products don’t face the extra cost.

- The government collects tariff revenue instead of relying on income tax from its citizens.

But here’s the catch: Companies don’t absorb these costs—they pass them on to consumers. That means the prices of imported goods go up, which can affect everything from electronics to clothing to cars.

Eliminating Income Taxes: What Would It Mean for Americans?

One of the most jaw-dropping parts of Trump’s speech was his promise to end federal income taxes. While this may sound like a dream for hardworking Americans, the reality is far more complex.

On the surface, removing income taxes means:

- More money in people’s paychecks (since the government wouldn’t take a cut).

- Potential relief for middle-class and low-income workers.

- More disposable income to boost spending and investment.

However, the problem arises when looking at government funding. The U.S. government relies heavily on income taxes to fund everything from infrastructure to defense to social programs. If those taxes are removed, the government would need to replace that revenue—hence the increased reliance on tariffs.

The big question is: Would tariff revenue be enough to cover what’s lost from income tax? Critics argue that higher consumer prices could erase any benefits people gain from tax cuts.

Why Many Economists and Experts Are Worried

While Trump’s plan excites some Americans, experts warn that history has shown tariffs can have dangerous side effects.

After World War II, advanced economies moved away from tariffs because they often led to:

- Reduced international trade, as countries retaliate with their own tariffs.

- Higher prices for consumers, since businesses raise prices to offset the costs.

- Potential trade wars, which can hurt American exports.

The Council on Foreign Relations has repeatedly cautioned that excessive tariffs can slow economic growth rather than boost it. A trade war with China, Canada, Mexico, and the European Union could make American goods less competitive globally, leading to job losses in industries dependent on exports.

Public Reactions: Excitement, Shock, and Skepticism

Trump’s proposal has sparked a huge reaction across social media. After clips of his speech went viral, many Americans were left stunned by the radical plan.

- One user simply wrote, “Wow.”

- Another commented, “Not a huge fan of him, but reducing or canceling income tax would make a huge difference for us.”

- A third added, “American citizens shouldn’t pay. We should tariff all of the other countries that have used our economy as a piggy bank.”

Supporters believe Trump is putting America first, ensuring foreign nations pay their fair share while Americans keep more of their earnings. However, critics warn that the average citizen will ultimately pay the price through higher costs on everyday goods.

Could This Plan Actually Work? The Road Ahead

The reality is Trump’s vision would require significant changes to U.S. tax law and trade agreements. Here are the challenges:

- Congress Approval – To eliminate federal income taxes, Congress would need to pass sweeping tax reform, which would likely face intense opposition.

- International Trade Relations – Countries like China, Canada, and Mexico may respond with counter-tariffs, making it harder for U.S. companies to sell goods overseas.

- Economic Impact on Middle-Class Americans – While tax cuts sound appealing, higher prices on imports could neutralize the financial benefits for most citizens.

Despite these challenges, Trump’s base remains loyal, and many believe he is the only leader bold enough to rewrite America’s economic playbook.

Final Thoughts: A Bold Vision with Uncertain Outcomes

Trump’s plan to make America “more powerful than ever before” is undeniably ambitious. If successful, it could transform the economy, eliminate income taxes, and boost domestic industries. However, the risk of inflation, trade wars, and economic instability makes this proposal a gamble.

The biggest question remains: Will this plan truly benefit everyday Americans, or will it lead to unintended consequences that outweigh the gains?

One thing is certain—this debate is far from over. With Trump’s policies once again at the center of national discussions, Americans will need to decide whether they’re ready to take this radical economic leap forward.