Money comes and goes, even for the wealthiest people on the planet. In a surprising turn of events, five billionaires who attended Donald Trump’s 2017 inauguration have collectively lost $209 billion in wealth over the years.

These billionaires—Elon Musk, Jeff Bezos, Mark Zuckerberg, Sergey Brin, and Bernard Arnault—were once at the peak of their financial success. But shifts in the global economy, stock market fluctuations, and company-specific challenges have significantly affected their fortunes.

What happened? Let’s break down the financial downfall of these five ultra-rich individuals and why their wealth took a hit.

The Rise and Fall of Billionaire Fortunes

At the time of Trump’s inauguration on January 20, 2017, the stock market was on an upswing. Investors were optimistic about new tax cuts, deregulation, and business-friendly policies. Tech companies, luxury brands, and e-commerce giants flourished.

Video: Billionaires at Trump’s Inauguration Have Since Lost $209 Billion

However, market trends changed in the following years. Political uncertainties, economic downturns, regulatory crackdowns, and shifting consumer behavior impacted the fortunes of some of the world’s wealthiest individuals.

Stock Market Volatility: A Billionaire’s Worst Enemy

Shortly after Trump took office, the stock market showed early gains. However, unexpected shifts in government policies, trade wars, and inflation concerns led to a sharp market decline.

- The S&P 500 Index fell by nearly 7% within a short period.

- Many tech stocks lost value as government regulations tightened on big corporations.

- The luxury sector faced challenges, especially with new tariffs on European goods.

For the billionaires who had amassed their fortunes through tech, e-commerce, and luxury goods, these market shifts proved costly.

Elon Musk: The Biggest Loser of the Group

Loss: $145 billion

Elon Musk, the billionaire CEO of Tesla and SpaceX, saw his wealth skyrocket to $486 billion at its peak. However, things took a turn as Tesla’s stock price dropped significantly due to a mix of factors:

- Production issues and delivery delays frustrated investors.

- Economic slowdowns affected consumer spending on electric vehicles.

- Musk’s political statements and Twitter activity alienated some customers.

Despite still being one of the richest people in the world, Musk’s fortune took the biggest hit among the billionaires present at Trump’s inauguration.

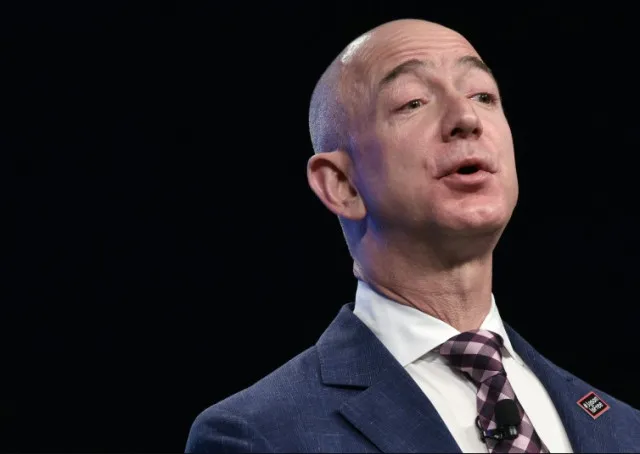

Jeff Bezos: Amazon’s Sales Slump Hits Hard

Loss: $31 billion

Jeff Bezos, the founder of Amazon, was once the world’s richest man. However, Amazon’s stock dropped due to slowing sales growth and increased competition.

- Consumer spending shifted post-pandemic, leading to weaker e-commerce demand.

- Rising operational costs cut into Amazon’s profits.

- A 15% decline in sales contributed to a major drop in Bezos’s wealth.

Interestingly, Amazon donated $1 million to Trump’s inauguration, but that didn’t shield Bezos from market struggles.

Sergey Brin: Google’s Parent Company Faces a Setback

Loss: $23 billion

Sergey Brin, co-founder of Google’s parent company Alphabet Inc., also saw a major financial hit.

- Alphabet missed revenue targets, causing its stock price to plummet.

- Increased government regulations on Big Tech impacted growth.

- A 7% drop in Alphabet’s stock led to significant losses for Brin.

While Google remains one of the most dominant tech companies, investors have grown cautious about its future regulatory challenges.

Mark Zuckerberg: Facebook’s Rough Ride

Loss: $8 billion

Mark Zuckerberg, CEO of Meta (formerly Facebook), wasn’t spared from the tech market’s downturn. His company faced:

- Privacy scandals and public scrutiny over misinformation.

- A major stock drop of 21%, reducing Zuckerberg’s personal fortune.

- Increased competition from platforms like TikTok.

Despite his losses, Zuckerberg managed to recover better than others on this list, as Meta continues to expand into virtual reality and AI.

Bernard Arnault: Luxury Market Takes a Hit

Loss: $5 billion

Bernard Arnault, the French billionaire behind Louis Vuitton Moët Hennessy (LVMH), faced smaller but notable financial losses.

- Tariffs on European luxury goods made his products more expensive for American consumers.

- The global luxury market slowed, especially in China and Europe.

- His wealth dipped by $5 billion, though he remains among the richest men in the world.

Despite his close ties to Trump, even Arnault couldn’t escape the economic challenges that affected the luxury industry.

Video: 5 Billionaires At Trump’s Inauguration See $209 Billion In Losses | World Business Watch | WION

What Can We Learn From These Billionaire Losses?

The downfall of these billionaires isn’t just about numbers—it reflects broader economic trends that impact businesses, markets, and everyday people.

- Stock market fluctuations can drastically change fortunes overnight.

- Regulations on Big Tech have long-term consequences on billionaire wealth.

- Global trade policies affect industries from e-commerce to luxury fashion.

Even the world’s wealthiest individuals aren’t immune to market risks and economic uncertainty.

Conclusion: Wealth Comes and Goes—Even for Billionaires

While these five billionaires still rank among the richest people in the world, their combined $209 billion loss proves that no fortune is untouchable.

Their presence at Trump’s inauguration might have symbolized power and influence at the time, but years later, shifting economic forces have humbled even the biggest names in business.

Will they recover? Most likely. But their financial struggles serve as a reminder that wealth, no matter how vast, is never guaranteed.