In today’s digital world, scam attempts are more sophisticated and frequent than ever. But sometimes, the biggest warning signs are in the smallest details. If you receive a text with the phrase “Would you kindly,” it’s time to be on high alert. This seemingly polite phrase is actually a favorite tool of scammers, and falling for it could lead you down a dangerous path. Read on to find out why this phrase is a red flag, how scammers use it, and what you should do if you receive a message like this.

The Hidden Danger Behind “Would You Kindly”

Why would a phrase as harmless-sounding as “Would you kindly” be a cause for concern? At first glance, it seems polite, even friendly. However, this phrase isn’t one commonly used in American English, and that’s exactly why it should make you suspicious. According to Tim Bajarin, a technology analyst with over 40 years of experience, the word “kindly” is often used in countries with British influences where English is not the native language. In the U.S., people don’t typically phrase requests this way. So, if you see “Would you kindly” in a message, there’s a good chance it’s from someone trying to pose as a friendly, trustworthy source—usually, to scam you.

Why Scammers Use Uncommon Language in Texts

Scammers often use language that seems just a bit off because it allows them to establish a subtle sense of authority. By using words like “kindly,” they’re trying to seem polite and formal, which may make their request appear more legitimate. However, these linguistic quirks often reveal their true intent. Unfamiliar language can be an indication that the sender isn’t who they claim to be, as Doug Shadel, founder of Fraud Prevention Strategies, explains. He warns that any unsolicited message should make you wary, especially when the language is slightly unusual.

How Scammers Reel You In: Common Phrases and Strategies

The phrase “Would you kindly” is just one of many tricks scammers use. They know that people are getting savvier, so they’ve adapted their tactics. Instead of sending obvious messages with bad grammar or strange punctuation, scammers now use seemingly innocent conversation starters. Here are a few examples:

- “Did I miss you today?”

- “Hi, how are you?”

- “I’ll be late for the meeting.”

These messages are vague and designed to prompt a response. When you reply, they’ll follow up with requests for personal information, pleas for help, or investment opportunities, often related to cryptocurrency or gift cards. The goal is to gain your trust and then exploit it.

The Psychology Behind Friendly Openers

Scammers know that people are more likely to trust someone who seems familiar. By starting with a question or a greeting, they make you feel like you’re part of an ongoing conversation. Responding to these messages gives scammers the chance to lure you into a trap. They may try to build rapport, appeal to your emotions, or even pretend to be someone you know. Once they think you’re hooked, they’ll push for financial gain, like asking you to invest in a fraudulent scheme or send them money under false pretenses.

Why You Shouldn’t Engage with Unsolicited Messages

As tempting as it may be to ask, “Who is this?” or let the person know they’ve contacted the wrong number, it’s best not to engage at all. According to Shadel, any unsolicited message—whether it’s a text, email, or social media message—should be viewed with suspicion. Scammers often send out hundreds of these messages, hoping that just one person will respond. By engaging, you’re signaling that your number is active, which could lead to more scam attempts in the future.

What to Do Instead of Replying

If you receive an unsolicited message with phrases like “Would you kindly” or other suspicious language, take the following steps:

- Delete the Message Immediately: Don’t waste time wondering who sent it. The safest option is to delete it right away.

- Report the Message as Junk: Most messaging platforms and email services have a reporting feature. By marking it as spam or junk, you’re helping to protect others from receiving similar messages.

- Block the Number: If the message came from a phone number, block it to prevent future messages from the same sender.

- Do Not Click Any Links: Never click on any links or attachments from an unknown sender. This can lead to malware being installed on your device or a phishing attempt to steal your information.

Recognizing Common Scams: Imposter Messages and Phishing Attempts

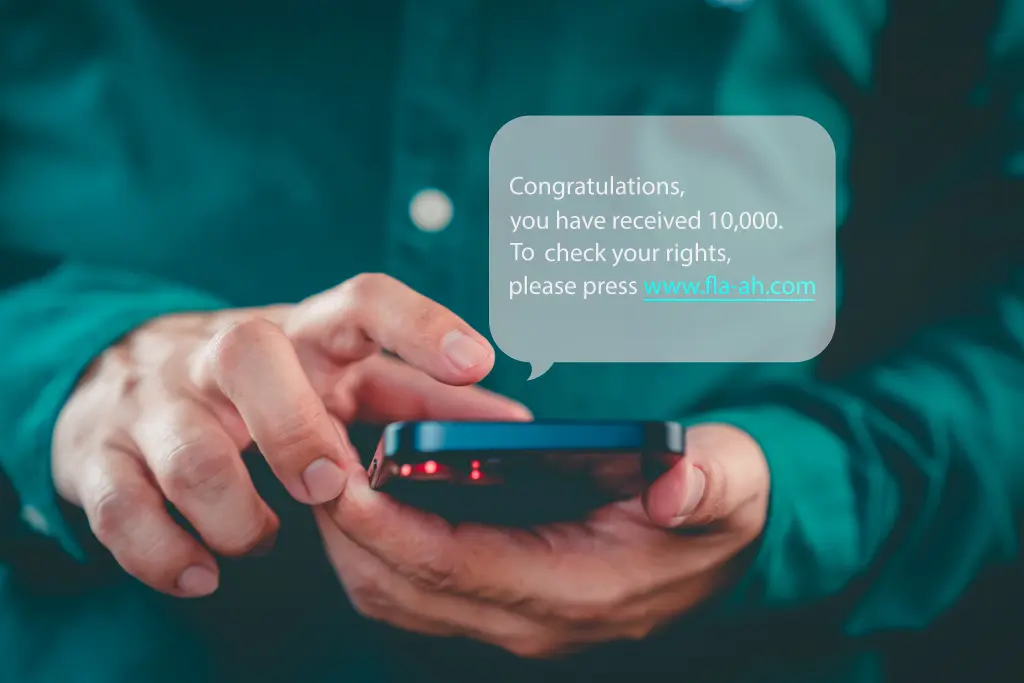

Scammers are becoming increasingly creative, and they often pose as trusted organizations to trick you into sharing personal information. Here are a few types of imposter scams you should watch out for:

- Bank Alerts: Scammers may claim to be from your bank and say there’s an issue with your account. They’ll include a link for you to “verify” your information, but clicking it could compromise your account.

- Government Notifications: Messages claiming to be from the IRS, Social Security Administration, or other government agencies should be treated with extreme caution. Government organizations rarely initiate contact through text messages.

- Fake Job Offers: Another common scam involves job offers from companies you’ve never heard of. They might ask for your personal information right away or request payment for “training materials.”

If you’re ever uncertain about the legitimacy of a message, visit the organization’s official website and contact them directly. Avoid using the contact information provided in the suspicious message.

Protecting Yourself from Text Scams: Essential Tips

Staying safe from text scams involves a few simple but effective practices. By being proactive, you can avoid falling victim to fraudulent schemes:

- Enable Spam Filters on Your Phone: Many smartphones have spam filters or call-blocking features that can automatically detect potential scam messages.

- Be Skeptical of Unsolicited Requests: If a message asks for money, personal information, or access to your accounts, treat it as a scam until proven otherwise.

- Educate Yourself on Common Scam Techniques: Familiarize yourself with the latest scams to stay one step ahead of the fraudsters.

- Monitor Your Bank Accounts and Credit Reports: Regularly check your financial accounts for suspicious activity. Early detection can help you address potential issues before they escalate.

Conclusion: Trust Your Instincts and Stay Alert

In today’s world, scammers are constantly developing new tactics to trick people into sharing personal information or handing over their hard-earned money. One of the simplest ways to protect yourself is by recognizing red flags, like the phrase “Would you kindly,” and avoiding unsolicited messages altogether.

Remember, if a message feels off, it probably is. Trust your instincts, delete suspicious texts, and report them as junk. By staying informed and cautious, you can avoid falling victim to these increasingly sophisticated scams. Protect yourself and your personal information—don’t let scammers get the best of you.