The cryptocurrency world is no stranger to extreme volatility, but few anticipated the staggering collapse of the $TRUMP meme coin. Initially launched as a way to celebrate Donald Trump’s political brand, the coin skyrocketed in value before experiencing a dramatic downfall. Now, Trump supporters who invested in the token are facing a collective loss of $12 billion, leaving many wondering whether meme coins are nothing more than a financial trap.

Let’s take a deep dive into the rise and fall of $TRUMP coin, the impact of meme coins on the crypto market, and the legislative response that could reshape the future of these digital assets.

The Rise and Fall of $TRUMP Coin

When the $TRUMP coin was introduced in January 2025, it was marketed as a symbol of political and financial prosperity. With Trump’s presidential campaign gaining momentum, supporters saw the coin as a way to express loyalty while potentially making a fortune.

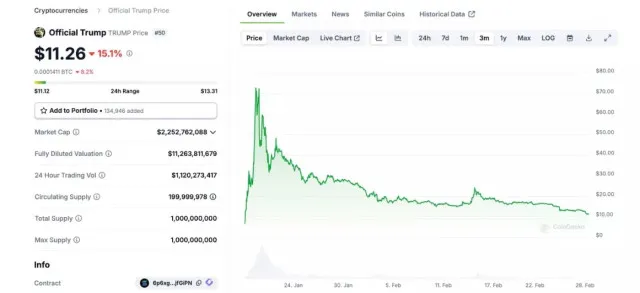

At first, things looked promising. Early investors saw massive gains, with the token soaring to an all-time high of $73.43 just days after its launch. Some traders became millionaires overnight, and social media was flooded with stories of quick success.

However, as with many meme coins, the hype didn’t last. Within weeks, the value of $TRUMP coin plummeted, dropping over 80% and settling around $11.27. The rapid decline wiped out billions of dollars in market value, leaving investors scrambling.

Why Did the $TRUMP Coin Collapse?

Several factors contributed to the downfall of $TRUMP coin, proving once again that meme coins are among the riskiest investments in the crypto world.

- Lack of Utility – Unlike Bitcoin or Ethereum, which have real-world applications, meme coins are often driven by hype rather than actual use cases. Once the initial excitement wore off, investors had little reason to hold onto their tokens.

- Pump and Dump Schemes – Reports suggest that large investors (whales) may have cashed out their holdings, causing the price to nosedive. As the value dropped, panic selling spread, further accelerating the decline.

- Overall Market Downturn – The broader cryptocurrency market also played a role. Bitcoin, which reached an all-time high of $108,786, has since dropped to $79,844. The dip in major cryptocurrencies affected speculative assets like meme coins even more severely.

- Political Uncertainty – While the coin was linked to Trump’s campaign, there was no official endorsement. As media outlets and regulatory bodies scrutinized the coin’s legitimacy, confidence in its long-term success weakened.

How Does $TRUMP Coin Compare to Other Meme Coins?

The $TRUMP coin isn’t the only politically-themed cryptocurrency to struggle. Melania Trump’s meme coin, $MELANIA, has also taken a significant hit.

- The coin peaked at $13.73 but has since plummeted, leaving investors with huge losses.

- A $10,000 investment at its peak is now worth just $652.44, demonstrating the extreme risk of meme coin speculation.

Meme coins, by nature, tend to have short-lived success. While some (like Dogecoin) have managed to stay relevant, most follow a predictable pattern of hype, rapid price increase, and inevitable crash.

The Ripple Effect on the Cryptocurrency Market

The collapse of $TRUMP coin and $MELANIA reflects a broader crypto market correction.

Bitcoin’s decline from its record high signals that the entire sector is experiencing volatility, which affects smaller coins even more dramatically. Investors are becoming more cautious, questioning whether meme coins hold any real long-term value or if they are just another form of digital gambling.

This downturn has led to increased skepticism about the future of meme coins and whether they should be considered serious investment opportunities. Some analysts believe the collapse of $TRUMP coin is a wake-up call for investors to focus on projects with real utility rather than chasing quick profits.

Legislative Response: Could Meme Coins Be Regulated?

With billions lost, lawmakers have taken notice of the risks associated with meme coins—especially those tied to political figures.

California Representative Sam Liccardo has proposed new legislation called the Modern Emoluments and Malfeasance Enforcement (MEME) Act. This bill aims to regulate the involvement of public officials and their families in the cryptocurrency market, preventing them from profiting off politically themed digital assets.

Liccardo argues that these meme coins are being used as a tool to exploit the public, creating financial bubbles that harm everyday investors. The bill focuses on:

- Preventing insider trading – Public figures and their families should not financially benefit from tokens linked to their political influence.

- Increasing transparency – Crypto projects must disclose whether they have direct affiliations with political candidates or campaigns.

- Protecting investors – The legislation aims to minimize cases where investors lose money due to hyped-up projects with no real substance.

While the bill has yet to pass, it signals a growing concern among lawmakers about the intersection of cryptocurrency, politics, and financial ethics.

What’s Next for $TRUMP Coin Investors?

With $TRUMP coin down over 80%, many investors are facing huge losses. Some are holding out hope for a rebound, while others have already cut their losses and moved on.

For those still invested, the future remains uncertain:

- If hype around Trump’s campaign picks up again, the coin might see temporary price increases.

- However, without real-world use or long-term support, it’s unlikely to recover to its previous highs.

- If regulations tighten, politically-themed meme coins may face even greater scrutiny, further limiting their potential.

The reality is that meme coins are among the most speculative investments in the financial world. While some traders have struck gold, most find themselves caught in a cycle of hype, crash, and regret.

Conclusion: A Costly Lesson for Meme Coin Investors

The $12 billion loss from $TRUMP coin serves as a stark reminder that meme coins are incredibly risky. While they can generate short-term excitement and profits, they rarely hold long-term value.

For Trump supporters who saw the coin as both a financial opportunity and a political statement, the crash has been a harsh reality check. The volatility of these tokens proves that crypto markets can be unpredictable, and blindly following hype can lead to devastating losses.

As lawmakers push for more regulation, and investors become more cautious, the era of meme coins dominating the crypto market may be coming to an end. Whether $TRUMP coin will recover or fade into history remains uncertain—but for those who lost fortunes, the lesson is clear: invest wisely, and never put money into a project based purely on hype.